The Union Ministry of Finance announced through tweets on August 24, 2020 that now businesses with an annual turnover of up to Rs 40 lakh will be exempt from GST registration.

Earlier, (when GST implemented) only businesses with an annual turnover of Rs 20 lakh were exempted from GST horizon. The Finance Ministry made the announcement through a series of tweets on the occasion of the first death anniversary of former Finance Minister Lt. Arun Jaitley.

The Finance Ministry paid respects to the late leader and remembered his lasting contribution to nation-building and the legacy he left behind as Union Finance Minister during 2014-19. The Ministry acknowledged through its tweets the key role of Lt. Arun Jaitley had played in the implementation of GST, which will go down in history as one of the most fundamental landmark reforms in Indian taxation.

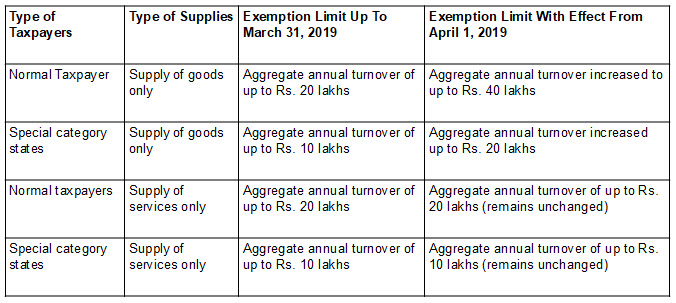

The original notification was released on 7th March, 2019 vide notification no. 10/2019 to give exemption from registration for any person engaged in exclusive supply of goods and whose aggregate turnover in the financial year does not exceed Rs. 40 Lakhs (effective from 1st April,2019), earlier it was 20 lakhs.

For Special category state limit was also raised from 10 lacs to 20 lacs for exclusive supply of goods.

Limit for exemption of GST registration for suppliers of goods and services both will be Rs 20 lakhs and not Rs 40 lakhs.

However, the hilly and north eastern states were given an option. They could either choose Rs. 20 lakhs or Rs. 40 lakhs as the turnover limit for GST exemption in case of supplier of goods.

Furthermore, this exemption limit of up to Rs 40 Lakhs is not applicable for persons who are:

- • Required to take compulsory registration under Section 24 of the CGST Act

- • Involved in making supply of goods such as:

- Ice cream and other edible ice whether or not containing cocoa

Pan masala

Tobacco and tobacco manufactured substitutes

The threshold for registration for service providers would continue to be Rs 20 lakhs and in case of Special category states Rs 10 lakhs.

New registration limit snapshot given below:

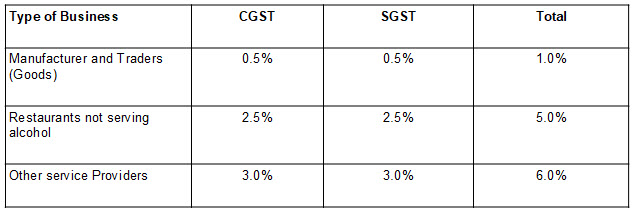

The Ministry of Finance also added that those with a turnover up to Rs 1.5 crore can opt for the Composition Scheme and pay only 1 percent tax.

Vide Notification No. 14/2019 dated 7th march,2019 extended the limit of threshold of aggregate turnover for availing Composition Scheme u/s 10 of the CGST Act, 2017 to Rs. 1.5 crores from 1 crores.

Threshold Limit for the composition scheme enhanced to 1.5 crore, for all States except Rs.75 lacs for (i) Arunachal Pradesh, (ii) Manipur, (iii) Meghalaya, (iv) Mizoram, (v) Nagaland, (vi) Sikkim, (vii) Tripura, (viii) Uttarakhand. Revised limit was effective from 1st day of April, 2019. Government also made major changes in rate of Composition scheme and also given an option to other service providers for availing said Scheme.

Further, A registered person being a service provider (or mixed supplier), whose aggregate turnover in the preceding financial year did not exceed Rs. 50 lakhs , may opt to pay, in lieu of the tax payable by him, an amount calculated at the rate of 6 % of turnover in lieu of the normal tax payable by him under section 9(1) of CGST Act, 2017.

However, in case of restaurant services, where aggregate turnover in preceding financial year did not exceed INR 1.5 crore, restaurant service provider may opt to pay tax at the rate of 5% (2.5%CGST+2.5%SGST) in lieu of normal tax.

It may be noted that manufacturers and traders are allowed to pay tax at the rate of 1 percent (0.5%CGST +0.5%SGST) of turnover respectively under composition scheme in case their aggregate turnover in preceding year does not exceed INR 1.5 crore.

The snapshot of Composition Scheme given below:

So, the above-mentioned tweet was just to recall the achievements done by Government in the memory of Lt. Shri Arun Jaitley and this was applicable w.e.f 1st April, 2019.

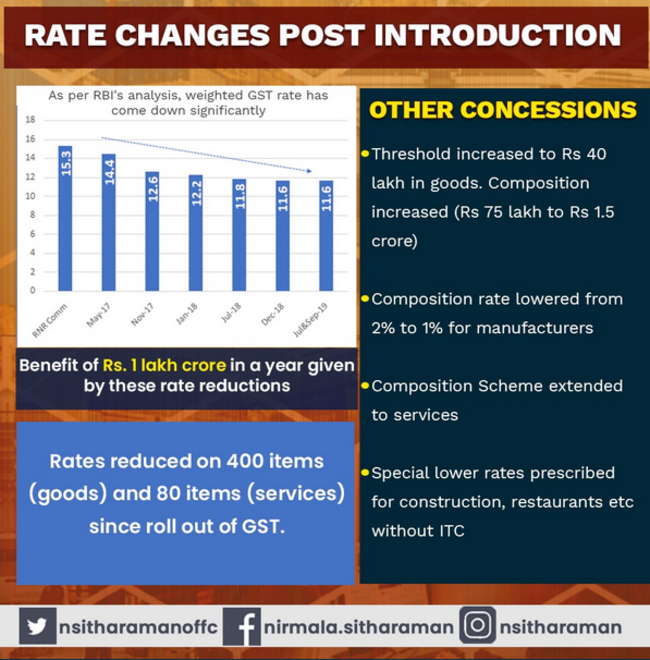

The honorable Finance Minister also highlighted and recalled some key benefits and major changes in GST after implementation through following Tweets:-

GST Benefits:

Key Highlights

The Finance Ministry noted that under GST, compliance has been improving steadily and the taxpayer base has almost doubled to 1.24 crore.

The Ministry’s tweets further read that GST has reduced the rate at which people have to pay tax. The Ministry revealed that the revenue-neutral rate as per the RNR Committee was 15.3 percent and in comparison to this, the weighted GST rate at present as per RBI is only 11.6 percent.

The Ministry stated that GST is now widely acknowledged as both consumer and taxpayer-friendly. While the high tax rates of the pre-GST era acted as a disincentive to paying tax, the lower GST rates have helped increase tax compliance.

Tax Rates brought down: 28% tax only on luxury items

The Ministry noted that after the implementation of GST, the tax rate on a large number of items was brought down. The Ministry informed that at present, the 28% GST tax slab includes mostly sin and luxury items. Out of the total 230 items included in the 28% tax slab earlier, around 200 items have been shifted to lower slabs.

The Ministry further tweeted saying that significant relief was extended to the construction sector, especially the housing sector. The housing sector has now been placed at the 5% tax rate. Besides this, GST on affordable housing has been brought down to 1 percent.

Taxpayer Base Doubles

The Ministry’s tweets also revealed that the taxpayer base has almost doubled since the rollout of the Goods and Services Tax.

The GST covered a total of 65 lakh assessee at the time of its inception. The number of the assessee has now exceeded 1.24 crore.

Fully Automated Process

The Ministry of Finance also informed in its series of tweeted that all process under GST has now become fully automated. Till now, over 50 crore returns have been filed online and around 131 crore e-way bills have been generated.