The Hon’ble Finance Minister Smt. Nirmala Sitharaman introduced the Finance Bill, 2020 on 1st February 2020. The provisions of Finance Bill, 2020 relating to direct taxes seek to amend the Income-tax Act, 1961, Prohibition of Benami Property Transactions Act, 1988 and Finance Act, 2013, to continue to provide momentum to the buoyancy in direct taxes through tax-incentives, reducing tax rates for co-operative society, individual and Hindu undivided family (HUF), deepening and widening of the tax base, removing difficulties faced by taxpayers, curbing tax abuse and enhancing the effectiveness, transparency and accountability of the tax administration. With a view to achieving the above, the various proposals for amendments are ordered under the heads Rates of income-tax, Tax Incentive, removing difficulties faced by taxpayers, Measures to provide tax certainty, Widening and deepening of tax base, Revenue mobilisation measures, Improving effectiveness of tax administration, Preventing tax abuse, and rationalisation of provisions of the Act.

A QUICK GLANCE AT KEY TAKEAWAYS OF BUDGET 2020:

-

-

Any tax system requires trust between taxpayers and the administration. This will be possible only when taxpayer’s rights are clearly enumerated. With the objective of enhancing the efficiency of the delivery system of the Income Tax Department, the Finance Bill 2020 proposed to be introduced a new section 119A to empower and to mandate the Central Board of Direct Taxes (CBDT) to adopt and declare a Taxpayer’s Charter, which shall be the part of statute, to issue such order, guideline, and instructions to other income tax Authorities for the administration of charter.

-

In order to ease the process of allotment of Permanent Account Number (PAN), system shall be launched under which PAN shall be instantly allotted online on the basis of Aadhaar without any requirement for filling up of detailed application form.

-

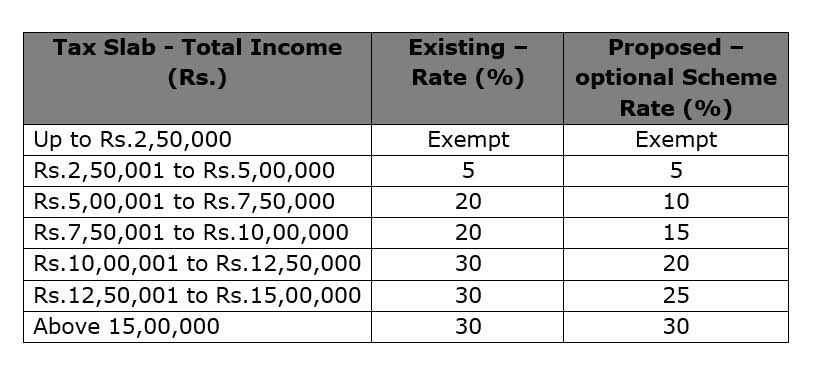

In order to provide significant relief to the individual taxpayers and to simplify the Income-tax law, It is proposed to bring a new and simplified personal income tax regime wherein income tax rates will be significantly reduced for the individual taxpayers who forgo certain deductions and exemptions. The simplified and new income tax regime shall be optional for the individual taxpayers to be taxed at following lower rates if they do not want to avail specified exemption/deductions in accordance with Section 115BAC of the Act. The individual or HUF opting for taxation under the newly inserted section 115BAC of the Act shall not be entitled to the exemptions/ deductions stated therein. Some of the 70 exemptions and deductions, the Assessee won’t get in new regime are:

- Leave travel concession as contained in clause (5) of section 10;

- House rent allowance as contained in clause (13A) of section 10;

- Some of the allowance as contained in clause (14) of section 10;

- Allowances to MPs/MLAs as contained in clause (17) of section 10;

- Allowance for income of minor as contained in clause (32) of section 10;

- Exemption for SEZ unit contained in section 10AA;

- Standard deduction, deduction for entertainment allowance and employment / professional tax as contained in section 16;

- Interest under section 24 in respect of self-occupied or vacant property referred to in sub-section (2) of section 23. (Loss under the head income from house property for rented house shall not be allowed to be set off under any other head and would be allowed to be carried forward as per extant law);

- Interest under section 24 in respect of self-occupied or vacant property referred to in sub-section (2) of section 23. (Loss under the head income from house property for rented house shall not be allowed to be set off under any other head and would be allowed to be carried forward as per extant law);

- Deductions under section 32AD, 33AB, 33ABA;

Various deduction for donation for or expenditure on scientific research contained in sub-clause (ii) or sub-clause (iia) or sub-clause (iii) of sub-section (1) or sub-section (2AA) of section 35; - Deduction under section 35AD or section 35CCC;

- Deduction from family pension under clause (iia) of section 57;

- Any deduction under chapter VIA (like section 80C, 80CCC, 80CCD,80D, 80DD, 80DDB, 80E, 80EE, 80EEA, 80EEB, 80G, 80GG, 80GGA, 80GGC, 80IA, 80-IAB, 80-IAC, 80-IB, 80-IBA, etc).

However, deduction under sub-section (2) of section 80CCD (employer contribution on account of employee in notified pension scheme) and section 80JJAA (for new employment) can be claimed.

-

A comparison of the existing tax regime versus the proposed optional regime has been tabulated below:

-

In case of individuals with business income, the option once exercised for a financial year shall be valid for that year and all subsequent years. Individuals who do not have any income from business or profession can exercise the option to avail lower tax rates every year. Therefore, individual and HUFs would need to determine the tax liability under the existing tax rates vis-a-vis new scheme and then select the best option.

-

In the new tax regime, substantial tax benefit will accrue to a taxpayer depending upon exemptions and deductions claimed by him. An individual who is currently availing more deductions and exemption under the Income Tax Act may choose to avail them and continue to pay tax in the old regime.

-

Some of the Pros and Cons of the new tax system.

- Availing new tax rates is not mandatory but is an Optional for the Assessee.

- Assessee not claiming any deduction previously may now be benefited with availing the option of the new tax rates.

- Relief in tax rates up to the Income of Rs.15,00,000.

- Assessee having income slightly more than 5,00,000 will end up paying tax at 10% instead of 20%.

- Option once exercised shall be valid for that Assessment Year and subsequent Assessment years. Therefore, option once exercised cannot be withdrawn.

- No Exemption or deduction under any other section or under chapter VI-A.

- No set off of any loss.

-

Impact on taxpayers – Here’s how the new tax regime will affect the tax outgo of taxpayers at different income levels.

-

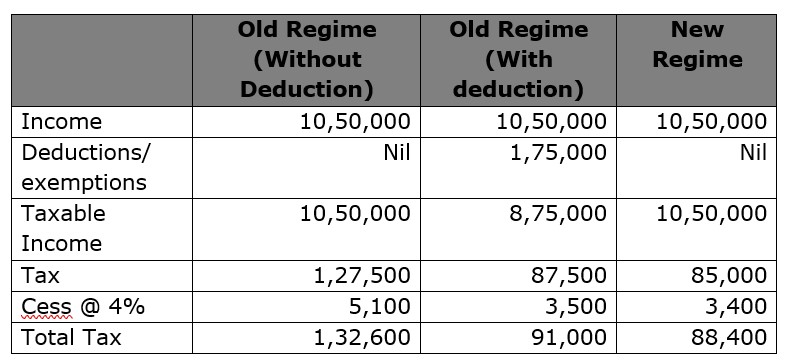

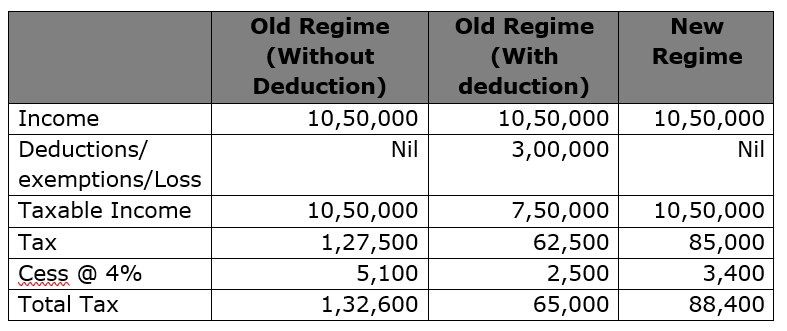

Income: 10.50 Lakhs

(Assuming deduction of Rs.1,50,000 u/s 80C, Rs.25,000 u/s 80D)

Income: 10.50 Lakhs

(Assuming deduction of Rs.1,50,000 u/s 80C, Loss from House Property Rs.1,50,000)

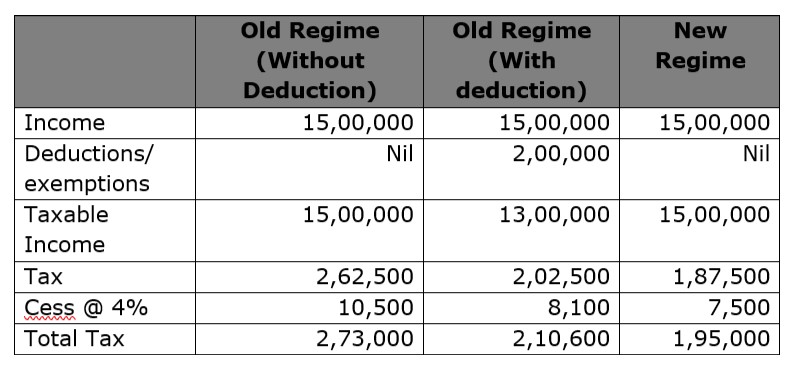

Income: 15 Lakhs

(Assuming deduction of Rs.1,50,000 u/s 80C, Rs.50,000 as standard deduction)

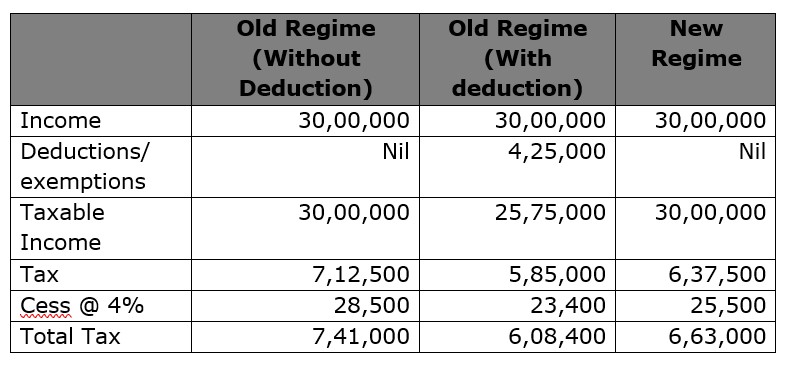

Income: 30 Lakhs

(Assuming deduction of Rs.1,50,000 u/s 80C, Rs.50,000 as standard deduction, Rs.25,000 u/s 80D, Rs.2,00,000 – Interest on Home Loan u/s 24 of the Act)

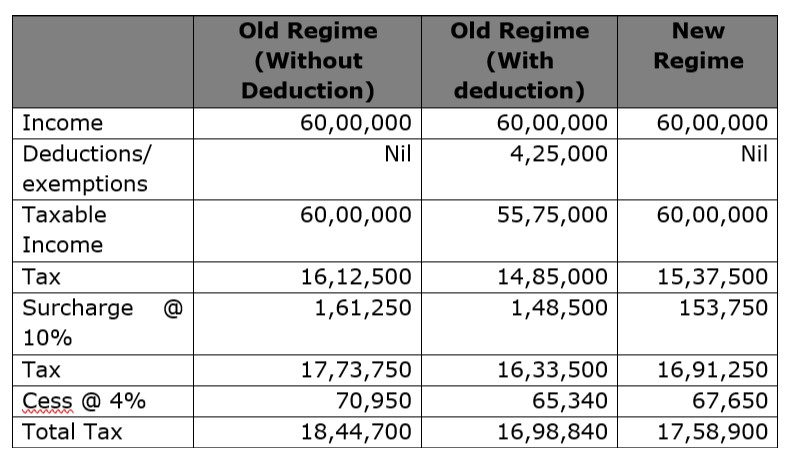

Income: 60 Lakhs

(Assuming deduction of Rs.1,50,000 u/s 80C, Rs.50,000 as standard deduction, Rs.25,000 u/s 80D, Rs.2,00,000 – Interest on Home Loan u/s 24 of the Act)

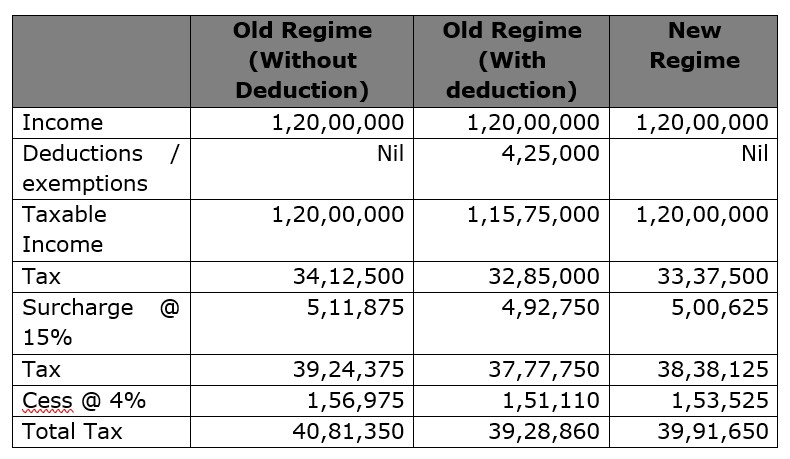

Income: 1.2 Crores

(Assuming deduction of Rs.1,50,000 u/s 80C, Rs.50,000 as standard deduction, Rs.25,000 u/s 80D, Rs.2,00,000 – Interest on Home Loan u/s 24 of the Act)

-

-

- Citizenship check to prevail over domicile check – With a target to cover stateless person, it is proposed that an Indian Citizen, shall be deemed to be a resident of India for tax purposes, if he is not liable to tax in any other country or territory by reason of his domicile or residence.

-

Indian Citizens/ PIO stay in India restricted to 120 days instead of 182 days – One of the condition, to check the residential status of an individual in India, is that his period of stay in India should be more than 60 days. However, in case of an Indian Citizen or a person of Indian origin, the Income-tax Act provides relaxation of up to 182 days for residency check. To curb the misuse of the said relaxation, the exception provided for Indian Citizen or a person of Indian origin, in clause (b) of Explanation 1 of section 6(1) is proposed to be decreased to 120 days from existing 182 days.

-

Non-Ordinarily Resident redefined – A person is said to be ‘not ordinarily resident’ in India in any previous year, if such person is (a) an individual who has been a non-resident in India in 7 out of the 10 previous years preceding that year; or (b) a HUF whose manager has been a non-resident in India in seven out of the ten previous years preceding that year.

-

The Taxation Laws (Amendment) Act, 2019 inserted section 115BAA and section 115BAB to provide domestic companies with an option to pay tax at the concessional tax rates. The Finance Bill, 2020 proposes that companies opting for the concessional rates shall not be allowed a deduction under any provisions of Chapter VI-A other than section 80JJAA or section 80M. Further, in order to attract investment in power sector, Section 115BAB shall include within its ambit to extent the concessional corporate tax rate of 15 percent to the new domestic companies engaged in the business of generation of electricity.

-

At present dividend is taxed in the hands of company distributing such dividend. It is proposed to remove the Dividend Distribution Tax and shift to classical system of taxing dividend in the hands of shareholders. The dividend shall be taxed only in the hands of the recipients at their applicable rate. Further, in order to remove the cascading effect, it has also proposed to allow deduction for the dividend received by holding company from its subsidiary.

-

-

Currently, ESOPs are taxable as perquisites at the time of exercise. This leads to cash-flow problem for the employees who do not sell the shares immediately and continue to hold the same for the long term. In order to give a boost to the start-up ecosystem, It is proposed to ease the burden of taxation on the employees by deferring the tax payment by five years or till they leave the company or when they sell their shares, whichever is earliest.

-

-

-

Section 80-IAC has been proposed to be amended to provide that deduction to an eligible start-up shall be available for a period of 3 consecutive assessment years out of 10 years. Earlier, this deduction was available for 3 consecutive financial years out of first 7 years. Further, the turnover limit for claiming such exemption has been proposed to raise to Rs. 100 crore which was earlier Rs. 25 crore.

-

-

-

The co-operative societies are currently taxed at a rate of 30% with surcharge and cess. As a major concession and in order to bring parity between the co-operative societies and corporates, a new section 115BAD has been proposed to be inserted to provide an option to co-operative societies to be taxed at 22% plus 10% surcharge and 4% cess with no exemption/deductions. Further, it is also proposed to exempt these co-operative societies from Alternative Minimum Tax (AMT) just like companies under the new tax regime are exempted from the Minimum Alternate Tax (MAT).

-

-

-

It is proposed to rationalise the provisions of section 115BAA and section 115BAB to provide that any domestic company (both existing as well as new) opting for concessional tax regime will not be allowed to claim any deduction under Chapter VI-A of the Act except deductions specifically allowed under said sections.

-

-

-

Section 44AB of the Income Tax Act, 1961 mandates a compulsory tax audit by a Chartered Accountant for those businesses whose total sales, turnover or gross receipts, if exceeds one crore rupees and in the case of professionals, whose gross receipt exceeds fifty lakh rupees in any previous year. To reduce the compliance burden on Small and Medium Enterprises (SME Business), the Hon’ble Finance Minister has proposed to increase the current threshold limit for business from one crore rupees to five crore rupees subject to (i) aggregate of five percent of all receipts received in cash during the previous year, and (ii) aggregate of five percent of all payments made in cash during the previous year.

-

-

-

To ease administration issues and avoid the last-minute rush, it is proposed to mandate all such Assessee’s to file their ‘Tax Audit Report’ at least one month in advance or prior to the due date of filing of such ‘Return of Income. Currently, the due date of filing such ‘Tax Audit Report’ is 30th September, which also proposed to amend as 31st October of the relevant assessment year. Thus, provisions of section 10, section 10A, section 12A, section 32AB, section 33AB, section 33ABA, section 35D, section 35E, section 44AB, section 44DA, section 50B, section 80-IA, section 80-IB, section 80JJAA, section 92F, section 115JB, section 115JC and section 115VW of the Act are proposed to be amended accordingly.

-

-

-

It is also proposed to do away with the existing distinction between a working and a non-working partner of a firm with respect to the due dates by amending dozens of relevant provisions prospectively with effect from 1st April, 2020 to apply from the assessment year 2020-21 onwards.

-

-

-

The amendment relating to extending threshold for getting books of accounts audited will have consequential effect on TDS/TCS provisions contained in sections 194A, 194C, 194H, 194I, 194J and 206C as these provisions fasten liability of TDS/TCS on certain categories of person, if the gross receipt or turnover from the business or profession carried on by them exceed the monetary limit specified in clause (a) or clause (b) of section 44AB. Therefore, it is proposed to amend these sections so that reference to the monetary limit specified in clause (a) or clause (b) of section 44AB of the Act is substituted. These amendments will take effect from 1st April 2020.

-

-

-

It is proposed to extend the time limit for approval of affordable housing project for availing deduction under section 80-IBA. The period of approval of the project by the competent authority is proposed to be extended to 31-03-2021. Earlier, the project was required to be approved by the competent authority during the period from 01-06-2016 to 31-03-2020.

-

-

-

Section 80EEA was introduced vide Finance (No.2) Act 2019 to provide a deduction for the interest on loan taken to buy an affordable residential house property. One of the conditions to claim this deduction is that loan should be sanctioned by the financial institution during the period from 01-04-2019 to 31-03-2020. The period of sanctioning of loan by the financial institution is proposed to be extended to 31-03-2021.

-

-

-

Rationalisation of deduction to insurance companies – It is proposed to provide that expenses disallowed in the hands of insurance companies for late payment of statutory dues shall be allowed in the year of payment.

-

-

-

In order to reduce litigation, it is proposed to reduce rate for TDS in case of fees for technical services (other than professional services) to Two percent from existing Ten percent in order to align the same with the rate of TDS on works contract.

-

-

-

In order to widen and deepen the tax net, it is proposed to provide that e-commerce operator shall deduct TDS on all payments or credits to e-commerce participants at the rate of One percent in PAN / Aadhaar cases and Five percent in non-PAN / Aadhaar cases. In order to provide relief to small businessman, it is proposed to provide exemption to an individual and HUF who receives less than Rs. 5 Lakhs and furnishes PAN / Aadhaar.

-

-

-

It is proposed to extend the TDS on interest paid by certain large co-operative societies whose gross receipts exceeds fifty crore rupees during the last financial year.

-

-

-

It is proposed to provide for tax collection at source (TCS) on remittance under Liberalised Remittance Scheme of Reserve Bank of India exceeding seven lakh rupees in a year and on sale of overseas tour package. Further, TCS is also proposed on sale of goods in excess of fifty lakh rupee in a year by a seller whose turnover is more than Ten crore rupees.

-

-

-

It is proposed to put an upper cap of seven lakh and fifty thousand rupees in a year on tax exempt employer’s contribution in recognized provident fund, superannuation fund and NPS in the accounts of an employee.

-

-

-

It is proposed to amend the definition of ‘work’ for the purpose of TDS under section 194C to provide that in a contract manufacturing, the raw material provided by the Assessee or its associate shall fall within the purview of the ‘work’ under section 194C.

-

-

-

Insertion of Section194K – Deduction of TDS in respect of income from units – TDS shall be deducted by any person paying to a resident any income in respect of units of Mutual Fund, Income from units from the administrator, income from units of specified company @ 10 percent. No TDS up to the amount of Rs.5000/-.

-

-

-

Rationalization of provisions of section 55 of the Act to compute cost of acquisition. It is proposed to clarify that in case of a capital asset, being land or building or both, the fair market value of such an asset on 1st day of April, 2001 shall not exceed the stamp duty value of such asset as on 1st day of April, 2001, where such stamp duty value is available.

-

-

-

Currently, while taxing income from capital gains, business profits and other sources in respect of transactions in real estate, if the consideration value is less than circle rate by more than 5 percent, the difference is counted as income both in the hands of the purchaser and seller. In order to minimize hardship in real estate transaction and provide relief to the sector, it is proposed to increase the limit of 5 percent to 10 percent. Safe harbour limit of 5 percent under Section 43CA, 50C and 56 has been extended to 10 percent. These provisions shall not apply if the stamp duty value of an immovable property does not exceed 10 percent of the consideration or Rs. 50,000, whichever is higher. This amendment will take effect from 1st April 2021 and will, accordingly, apply in relation to the assessment year 2021-22 and subsequent assessment years.

-

-

-

Currently, a taxpayer is required to fill the complete details of the donee in the income tax return for availing deduction for donation. In order to ease the process of claiming such deduction, it is proposed to pre-fill the donee’s information in taxpayer’s return on the basis of information of donations furnished by the donee. This would result in hassle-free claim of deduction for the donation made by the taxpayer. Section 80G is proposed to be amended to provide that entities receiving donation shall be required to file a statement of the donation received and shall issue a certificate to donor. The mechanism shall be similar to TDS/TCS. Further, in order to claim the tax exemption, the charity institutions have to be registered with the Income Tax Department. In the past, the process of the registration was completely manual and scattered all over the country. In order to simplify the compliance for the new and existing charity institutions, it is proposed to make the process of registration completely electronic under which a unique registration number (URN) shall be issued to all new and existing charity institutions. Further, to facilitate the registration of the new charity institutions which is yet to start their charitable activities, it is proposed to allow them provisional registration for three years.

-

-

-

Fee for default relating to statement or certificate – If the institution or fund fails to deliver or cause to be delivered a statement within the prescribed time of section 80G or furnish a certificate Fee of Rs.200 per day for each day of default under section 234G. Further, penalty levied of Rs 10,000 to Rs 1.00 lakh under new section 271K of the Act.

-

-

-

It is proposed to rationalise the process of registration in the case of trusts, institutions, funds, university, hospital etc. and approval in the case of association, university, college, institution or company etc. It is also proposed to provide filing of statement of donation by donee so that the deduction claimed by the donor in its tax return can be pre-filled.

-

-

-

Reduction in limit of Deduction under section 80GGA from ten thousand to two thousand.

-

-

-

It is proposed to rationalise the provision regarding uploading of Form 26AS so as to include all the prescribed information.

-

-

-

It is proposed to rationalise the provisions relating to cost of acquisition and period of holding with respect to segregated portfolios to provide clarity to taxpayers holding such portfolios.

-

-

-

Amendment in the provisions of Act relating to verification of the return of income and appearance of authorized representative. Section 288 is proposed to be amended to provide that Insolvency Professional can appear before any Income-tax Authority or the Appellate Tribunal on behalf of an Assessee as its “authorised representative”.

-

-

-

An Assessee, who is engaged in the specified business, is allowed to claim deduction of capital expenditure under section 35AD. At present, an Assessee does not have any option of not availing the incentive under the said section. In order to facilitate opting for new concessional tax regime by the domestic companies, it is proposed to rationalise the provisions of section 35AD so as to provide an option for claiming deduction under section 35AD.

-

-

-

It is proposed to extend the ‘Compliance or Return Filing’ relief to non-residents whose total income consists royalty or fees for technical services subject to requisite tax has been deducted at source, by amending section 115A of the Act with prospective effect from 1st April, 2020 to apply from the assessment year 2020-21 onwards.

-

-

-

Widening the scope of Safe Harbour Rules and Advance Pricing Agreement – In order to provide tax certainty to taxpayers in the matter of attribution of profit to permanent establishment (PE), it is proposed to widen the scope of Advanced Pricing Agreement (APA) and Safe Harbour Regime (SHR), by providing that determination of attribution of profit to PE shall also be in the scope of SHR and APA.

-

-

-

It is proposed to amend the provision allowing India to enter into Double Taxation Avoidance Agreements (DTAA) with other countries or territories or association, to align with the new preamble mandated by Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (commonly referred to as MLI), as India has already ratified MLI.

-

-

-

It is proposed to defer the enactment of Significant Economic Presence (SEP) to Financial Year 2021-22 as G-20 OECD report on digital economy is expected by that time. It is also proposed to provide for source rule for revenue from advertisement targeted to India customers and revenue from sale of Indian sourced data.

-

-

-

It is proposed to align exemption from the provision of indirect transfer to Foreign Portfolio Investors in line with new SEBI FPI regulations. It is also proposed to rationalise the definition of royalty.

-

-

-

The conditions for setting up of offshore fund are proposed to be rationalised so as to facilitate setting up of fund management activity in India.

-

-

-

In order to incentivise the investment by the Sovereign Wealth Fund of foreign governments in the priority sectors, it is proposed to grant 100% tax exemption to their interest, dividend and capital gains income in respect of investment made in infrastructure and other notified sectors before 31st March 2024 and with a minimum lock-in period of 3 years. In order to make available foreign funds at a lower cost, it is proposed to extend the period of concessional withholding rate of 5 percent under section 194LC for interest payment to non-residents in respect of moneys borrowed and bonds issued up to 30th June 2023. It is also proposed to extend the period up to 30th June 2023 for lower rate of withholding of 5 percent under section 194LD for interest payment to Foreign Portfolio Investors (FPIs) and Qualified Foreign Investors (QFIs) in respect of bonds issued by Indian companies and government securities. It is further proposed to extend the concessional rate of withholding of 5 percent under section 194LD to the interest payment made on the Municipal Bonds. In order to incentivise listing of bonds at IFSC exchange. It is proposed to further reduce the withholding rate from 5 percent to 4 percent on interest payment on the bonds listed on its exchange.

-

-

-

A new clause is proposed to be inserted in Section 10 of the Income-tax Act to provide an exemption to a wholly-owned subsidiary of the Abu Dhabi Investment Authority (ADIA), which is a resident of the United Arab Emirates (UAE) and which makes investment, directly or indirectly, out of the fund owned by the Government of the United Arab Emirates and a sovereign wealth fund.

-

-

-

A new clause is proposed to be inserted in section 10 to provide an exemption in respect of income accruing or arising to Indian Strategic Petroleum Reserves Limited (ISPRL) as a result of an arrangement for replenishment of crude oil stored in its storage facility in pursuance to directions of the Central Government in this behalf subject to the condition of replenishment of crude oil within three years, where ISPRL being a wholly owned subsidiary of Oil Industry Development Board under the Ministry of Petroleum and Natural Gas.

-

-

-

Section 9A of the Act provides for a special regime in respect of offshore funds by providing them exemption from creating a “business connection” in India on fulfilment of certain conditions. It has been proposed that certain conditions for off-shore funds shall be relaxed.

-

-

-

Section 94B provides for the restriction on deduction of interest payment made by the Indian company or a permanent establishment of the foreign company in India to its Associated Enterprise abroad. Finance bill proposed that provisions of interest limitation would not apply to interest paid in respect of a debt issued by a lender which is a PE of a non-resident, being a person engaged in the business of banking, in India.

-

-

-

The scope of e-Assessment is proposed to be extended, so as to include the proceedings under Section 144 of the Act relating to best judgement assessment.

-

-

-

The Central Government may notify an e-scheme for the purposes of imposing penalty so as to impart greater efficiency, transparency and accountability. In this scheme the interface between the Assessing Officer and the Assessee in the course of proceedings shall be eliminated to the extent it is feasible technically.

-

-

-

The government is committed to bringing in transformational changes so that maximum governance is provided with minimum government. In order to impart greater efficiency, transparency and accountability to the assessment process, a new faceless assessment scheme has already been introduced. Currently, most of the functions of the Income Tax Department starting from the filing of return, processing of returns, issuance of refunds and assessment are performed in the electronic mode without any human interface. In order to take the reforms initiated by the Department to the next level and to eliminate human interface, it is proposed to amend the Income Tax Act so as to enable Faceless appeal on the lines of Faceless assessment. In order to achieve the motto of faceless assessment at CIT(A) level, an appellate system with dynamic jurisdiction, in which appeal shall be disposed of by one or more Commissioner (Appeals), has been proposed. The Central Govt. may notify the scheme in this regard by 31-03-2022.

-

-

-

No Dispute but Trust Scheme – ‘Vivad Se Vishwas’ Scheme – Currently, there are number of direct tax cases pending in various appellate forums i.e. Commissioner (Appeals), ITAT, High Court and Supreme Court. Under the proposed ‘Vivad Se Vishwas’ scheme, a taxpayer would be required to pay only an amount of the disputed taxes and will get complete waiver of interest and penalty provided he pays it by 31st March 2020. Those who avail this scheme after 31st March 2020 will have to pay some additional amount. The scheme will remain open till 30th June 2020. Taxpayers in whose cases appeals are pending at any level can benefit from this scheme to get relief from vexatious litigation process.

-

-

-

It is proposed to provide that stay under the first proviso to section 254(2A) shouldn’t be provided the Income Tax Appellate Tribunal (ITAT) unless the taxpayer has either paid twenty per cent of amount of demand or have provided security for an equal amount. Further stay under second provision to section 254(2A) can only be granted on an application made by the Assessee, if the delay in not disposing of the appeal is not attributable to the Assessee and the Assessee has deposited 20% of the amount of tax, interest, fee, penalty, or any other sum payable under the provisions of this Act. The total stay granted by ITAT cannot exceed 365 days.

-

-

-

Eligible Assessee for making a reference to DRP shall include a Non-resident as well. It is proposed that any variation done by the AO which is prejudicial to the interest of the Assessee (even if there is no impact on profits/losses) can be referred to DRP.

-

-

-

Approval of CIT/Director is required to conduct Survey – Power of survey has been proposed to be rationalized as under a) Where some information has been received from the prescribed authority, no Income-tax authority below the rank of Joint Director or Joint Commissioner shall conduct any survey without prior approval of the Joint Director or the Joint Commissioner; b) In any other case, no survey should be done by a Joint Director or a Joint Commissioner or an Assistant Director or a Deputy Director or an Assessing Officer or a Tax Recovery Officer or an Inspector of Income-tax without obtaining the approval of the Director or the Commissioner.

-

-

-

As a part of consolidation of the financial sector, the Government has brought out schemes for merger and amalgamation of public sector banks. In order to ensure that the amalgamated entities are able to take the benefit of unabsorbed losses and depreciation of the amalgamating entities, it is proposed to make necessary amendments to the provisions of the Income-tax Act.

-

-

-

It is proposed that Business Trusts will not be required to get listed on a recognised stock exchange for availing the benefit of pass-through allowed under section 115UA.

-

-

-

It is proposed to withdraw various exemptions provided to Union Pubic Services Commission (UPSC) Chairman and members and Chief Election Commissioner (CEC) and Election Commissioners in respect of certain perquisites or allowances under section 10(45) of the Income-tax Act and Section 8 of the Election Commission (Conditions of Service of Election Commissioners and Transaction of Business) Act, 1991.

-

-

-

It is proposed to rationalise the definition of ‘taxable commodities transactions’ for the purposes of levy of Commodity Transaction Tax.

-

-

-

Govt. proposes to exempt levy of stamp duty on transactions in stock exchanges established in IFSCs.

-

-

-

Eligibility limit for NBFCs for debt recovery under SARFAESI Act to be reduced to loan size of Rs. 50 Lakh.

-

-

-

Specified Government securities to be opened for NRIs.

-

-

-

To keep the reforms in GST, a simplified return shall be implemented from the 1st April 2020. It will make return filing simple with features like SMS based filing for nil return, return pre-filling, improved input tax credit flow and overall simplification.

-

-

-

Refund process under GST has been simplified and has been made fully automated with no human interface.

-

-

-

It is proposed to implement an electronic invoice in a phased manner on optional basis wherein critical information shall be captured electronically in a centralized system. It will facilitate compliance and return filing.

-

-

-

To discourage taxpayers to manipulate their books of accounts by recording false entries including fake invoices to claim wrong input credit in GST, a new section 271AAD has been proposed to be inserted to levy a penalty of an amount equal to the aggregate amount of such fake invoices.

-

-

-

Setting up of an Investment Clearance Cell to provide end to end facilitation.

-

-

-

Customs duty on items like footwear and furniture is being raised. It is proposed to reduce basic customs duty on imports of news print and light-weight coated paper from 10 percent to 5 percent.

-

-

-

As a revenue measure, it is proposed to raise excise duty, by way of National Calamity Contingent Duty on Cigarettes and other tobacco products. However, no change is being made in the duty rates of bidis.

-

-

-

In the larger public interest, anti-dumping duty on Purified Terephthalic Acid (PTA) is being abolished.

-

-

-

Health Cess at the rate of 5 percent is proposed to be imposed on the import of specified medical devices/equipment.

-

-

-

Government to sell part of its holding in LIC and IDBI bank.

-

-

-

Deposit Insurance Coverage limit to be increased From Rs. 1 Lakh to Rs. 5 Lakh per depositor.

-

-

The Hon’ble Finance Minister’s aim is to further simplify the tax laws and procedures but the same will only be seen in the coming times. Considering that the tax laws need continuing reforms which is a massive challenge, it needs to be pursued with full vigour.

DEVANG H. DIVECHA

B. Com (Hons), FCA.

Partner