The Central Board of Direct Taxes has brought about changes in the TCS provisions with effect from 1st October, 2020 through the Budget 2020 i.e. Finance Act, 2020. These changes shall affect a wide range of businesses across various industries. Hitherto, TCS was applicable to a select few industry verticals, but the applicability of section 206C (1H) of Income Tax Act 1961, have slated to affect a wide range of entities into the business of selling various kinds of goods. This white paper explains the new changes and we hope that it will answer most of your questions regarding the new levy. Read more to find out whether the new changes are applicable to your business or not.

Legal Provision as per Section 206C(1H) Income Tax Act, 1961

Every person, being a seller, who receives any amount as consideration for sale of any goods of the value or aggregate of such value exceeding fifty lakh rupees in any previous year, other than the goods being exported out of India or goods covered in sub-section (1) or sub-section (1F) or sub-section (1G) shall, at the time of receipt of such amount, collect from the buyer, a sum equal to 0.1 per cent of the sale consideration exceeding fifty lakh rupees as income-tax:

Provided that if the buyer has not provided the Permanent Account Number or the Aadhaar number to the seller, then the provisions of clause (ii) of sub-section (1) of section 206CC shall be read as if for the words “five per cent”, the words “one per cent” had been substituted:

Provided further that the provisions of this sub-section shall not apply, if the buyer is liable to deduct tax at source under any other provision of this Act on the goods purchased by him from the seller and has deducted such amount.

Explanation – For the purposes of this sub-section,-- “buyer” means a person who purchases any goods, but does not include,-

- the Central Government, a State Government, an embassy, a High Commission, legation, commission, consulate and the trade representation of a foreign State; or

- a local authority as defined in the Explanation to clause (20) of section 10; or

- a person importing goods into India or any other person as the Central Government may, by notification in the Official Gazette, specify for this purpose, subject to such conditions as may be specified therein;

- “seller” means a person whose total sales, gross receipts or turnover from the business carried on by him exceed ten crore rupees during the financial year immediately preceding the financial year in which the sale of goods is carried out, not being a person as the Central Government may, by notification in the Official Gazette, specify for this purpose, subject to such conditions as may be specified therein.

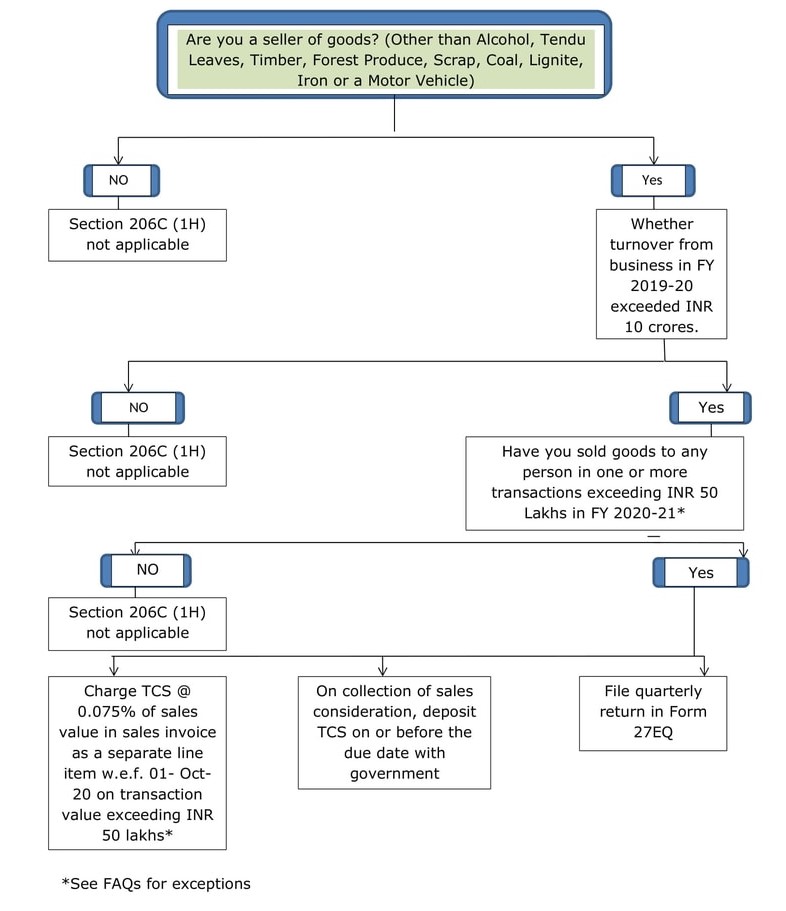

- 1. What are the new insertion made in Budget 2020 i.e. Finance Act, 2020 with respect to section 206C (1H)?

- As per Finance Act, 2020, every seller of goods (other than Alcohol, Tendu Leaves, Timber, Forest Produce, Scrap, Coal, Lignite, Iron or a Motor Vehicle), whose turnover from sale of goods exceeds INR 10 crores in the preceding financial year, shall be required to collect TCS at the rate of 0.1% (0.075% for FY 2020-21) from customers to whom sales after 30th September, 2020 exceeds INR 50 lakhs (E.g. For applicability of liability of TCS for sales in FY 2020-21, the sales of FY 2019-20 should exceed INR 10 crores). This provision is applicable from 1st October, 2020. It may be noted that these provisions are not applicable to service providers since it is applicable only to seller of certain kinds of goods.

- 2. Who is liable to collect tax on the sale of Goods?

- Tax is required to be collected by a person carrying on business whose total sales, gross receipts or turnover exceeds Rs. 10 crores in the financial year immediately preceding the financial year of sale.

Example, the liability to collect tax in the financial year (FY) 2020-21 arises if the turnover was more than Rs. 10 crores in FY 2019-20. There is no obligation to collect TCS in FY 2020-21 if turnover was less than Rs. 10 crores in FY 2019-20. - 3. From whom tax shall be collected?

- The tax shall be collected from a buyer if the following conditions are satisfied:

(a) There is a sale of goods to such a person;

(b) The seller receives any amount as consideration for the sale of any goods of the value or aggregate of such value exceeding Rs. 50 lakhs in any previous year; and

(c) The buyer should not be in the list of persons excluded from the provision for collection of tax.

The tax shall not be collected under this provision if the goods are sold by way of export out of India, or the tax is deducted or collected under any other provision. Further, the tax shall not be collected if the buyer is:

(a) Central Government; (b) State Government; {c) A:n Embassy, High Commission, a Legation, a Commission, a Consulate or Trade Representation of a Foreign state; (d) Local Authority; (e) A person importing goods into India; and Any other notified person. - 4. What shall be the timing of collection of tax?

- Section 206C(1H) provides as follows:

“Every person, being a seller, who receives any amount as consideration for sale of any goods of the value or aggregate of such value exceeding fifty lakh rupees in any previous year, other than the goods being exported out of India or goods covered in sub-section(1) or sub-section(1F) or sub-section(1G) shall, at the time of receipt of such amount, collect from the buyer, a sum equal to 0.1 per cent of the sale consideration exceeding fifty lakh rupees as income-tax”.

Following three interpretations can be derived after a plain reading of the provision:

a. Tax to be collected when both the amount of sale and the amount received as sale consideration exceeds Rs. 50 lakhs during the previous year;

b. Tax to be collected when the amount of sale exceeds Rs. 50 lakhs irrespective of the amount of sale consideration received during the previous year; or

c. Tax to be collected when the amount received as sale consideration exceeds Rs. 50 lakhs irrespective of the amount of sale made during the previous year.

The interpretation in the point (c) above shall be more convenient, realistic and reasonable and in support of this, we have the arguments discussed in the ensuing paragraphs.

On the doubt of applicability of the TCS provision on the consideration received before 01-10-2020, the CBDT in Circular No. 17, dated 29-09-2020, at Para 4.4.2(ii) has clarified that “this provision applies on receipt of sale consideration, thus the provision of this sub-section shall not apply on any sale consideration received before 01-10-2020. Consequently, it would apply on all sale consideration (including advance received for sale) received on or after 01-10-2020 even if the sale was carried out before 01-10-2020”. Though the clarification has been given in respect of another issue, but the language of the CBDT’s circular indicates that the tax should be collected when the consideration received during the previous year exceeds the threshold limit.

Further, it brings administrative convenience both for the collector and the revenue as it will be easy to correlate the actual receipt during the previous year with the tax so collected during the same period.

Thus, the tax should be collected at the time of receipt of amount from the buyer if the value of sale consideration received in a previous year exceeds Rs. 50 lakhs.

Example, the applicability of rate of tax has been enumerated in the below table: - 5. Whether TCS u/s 206C (1H) has to be collected on export sales?

- No TCS to be collected on export sale. These provisions do not apply to goods exported out of India

- 6. Is a non-resident, selling goods from outside India, required to collect tax at source under this section?

- The definition of a buyer in Explanation to Section 206C(1H) specifically excludes ‘any person importing goods into India’ from its ambit. Hence, the obligation to collect tax at source is not triggered in the hands of the non-resident seller.

- 7. Whether a transaction in securities through stock exchanges shall be subject to TCS under this provision?

- Concerns have been raised about the applicability of the TCS provision in respect of transactions through stock exchanges (or commodity exchange) as there is no one-to-one contract between the buyers and sellers.

The CBDT has clarified that provisions of this section shall not be applicable in relation to transactions in securities (and commodities) which are traded through recognised stock exchanges or cleared and settled by the recognised clearing corporation, including recognized stock exchanges or recognized clearing corporations located in International Financial Service Centre (IFSC). - 8. Whether TCS to be collected on the sale of immovable property by a developer?

- ’Goods’ means every kind of movable property subject to certain exceptions and inclusions. Thus, the immovable property shall not be treated as ’goods’. Consequently, the TCS shall not be collected from the sale of immovable property by a developer.

- 9. Whether TCS shall be collected on the sale of a motor vehicle?

- There is a specific provision in Section 206C(1F) for the collection of tax on the sale of a motor vehicle. Under this provision, the tax shall be collected from every buyer who pays any amount as consideration for the purchase of motor vehicle of value exceeding Rs. 10 lakhs. The Finance Act 2020 has introduced a general provision for collection of TCS on sale of goods under section 206C(1H). This provision specifically excludes TCS on motor vehicle, which is covered under section 206C(1F), from its ambit.

Vide Circular No. 22/2016, dated 8-6-2016, the CBDT has clarified that the provisions of Section 206C(1F) will not apply on sale of motor vehicles by manufacturers to dealers/distributors. The CBDT side Circular No. 17, dated 29-09-2020 now clarifies that the tax shall be collected under Section 206C(1F) in the case of sale of a motor vehicle to a consumer (B2C), and sub-section (1H) shall apply for the sale of motor vehicle to the dealers or distributors (B2B). Hence, the sale of Motor vehicles to dealers which is not covered in section 206C(1F) shall be subject to TCS under this new provision. Further, sales to consumer where the consideration for a single vehicle is less than Rs. 10 lakhs but the aggregate value of which exceeds Rs. 50 Lakhs during a previous year, it shall be subject to TCS under this new provision. - 10. Whether TCS is required to be collected on transaction in electricity?

- Section 206(1H) provides for the collection of tax on the sale consideration received for the sale of goods. The Apex Court in the case of State of Andhra Pradesh v/s. National Thermal Power Corporation (NTPC) (2002) 6 SCC 203, held that electricity is a movable property though it is not tangible. It is a ‘good’. Further, Custom Tariff Act has covered ’Electricity’ under heading 2716 00 00, which also clarifies that Electricity is a goods. Thus, it is clear that electricity is a good. Thus, the tax shall be collected from the consideration received in respect of the transaction in electricity.

A transaction in electricity can be undertaken either by way of direct purchase from the company engaged in generation of electricity or through power exchanges. The CBDT has clarified that the transaction in electricity, renewable energy certificates and energy-saving certificates traded through power exchanges registered under Regulation 21 of the CERC shall be out of the scope of TCS under this provision. Thus, it can be concluded that tax is required to be collected where electricity is purchased directly from electricity generation companies. - 11. Whether Fuel/ supplied to non-resident airlines be subject to TCS under this provision?

- A concern has been raised whether the tax should be collected from the supply of fuel to non-resident airlines. The CBDT vide Circular No. 17, dated 29-09-2020 has clarified that the provisions of this section shall not apply on the sale consideration received from the fuel supplied to non-resident airlines at airports in India.

- 12. Whether TCS should be collected on the sale of software?

- Taxation of software has always been a subject of debate under the Income-tax Laws. The issue was also litigative under the erstwhile indirect tax laws (VAT, Service Tax etc.) where states were levying VAT on the sale of goods and Centre were levying service-tax on the provision of services. With the passage of time, the Judiciary has laid down some principles, which enable the taxpayers, to determine when the supply of software would qualify as a supply of goods and when it would be a supply of services. The issue is not much litigative under the GST regime as the tax rate in both cases is the same.

However, in absence of any guidelines in the Income-tax, such classification has always been a subject matter of litigation. The Finance Act 2012 has made the clarificatory amendments in Section 9 to broaden the scope of taxation of royalty. This has been clarified by the amendment that the consideration for the use or right to use of computer software is a royalty. The factors of the medium, ownership, use or right to use and location have been clarified as immaterial. The amendments have, thus, given a new dimension to tax administration in the sphere of royalty taxation. The payment towards royalty is subject to TDS under Section 194J or Section 195. The provision of section 206C(1H) would not apply where the buyer is liable to deduct tax at source on the purchase of goods from the seller and has deducted the tax at source.

The Supreme Court in its landmark decision of Tata Consultancy Services v. State of A.P[2004] 141 Taxman 132 (SC) held that Canned software (off the shelf computer software) are ‘goods’ and as such assessable to sales tax. Hence, the requirement to collect TCS shall be decided on the basis whether the sale of software has been treated as ‘sale of goods’ or ‘sale of service’. If the same has been treated as a sale of service,

It shall not be subject to TCS but the provisions of TDS under section l94J or 195, as the case may be, may apply. However, if the sale of software has been treated as a sale of goods then the seller shall be liable to collect TCS subject to the fulfilment of other conditions of this provision. - 13. Whether TCS is liable to be collected on Sale of Jewellery by a Jeweller?

- Up to the previous year 2016-17, Section 206C(1D) requires the collection of tax at source at the rate of 1% from the sale consideration received on cash sale of bullion, jewellery or any other goods or for providing any service. The aforesaid provision has been omitted by the Finance Act, 2017 with effect from 1-4-2017.

The Finance Act 2020 has introduced a general provision for collection of TCS on sale of goods. Jewellery, being a movable property, is covered within the term goods. There is no specific exclusion under Section 206C(1H) for collection of TCS on sale of jewellery. Thus, a Jeweller shall be liable for the collection of tax if other conditions are also fulfilled. - 14. Whether TCS is liable to be collected from re-sale of goods?

- Under Section 206C(1H), a person shall be treated as a seller if the total sales, gross receipts or turnover of the business carried on by him exceeds the threshold limit. Once a person is qualified as a seller he will be liable for the collection of tax where the value or aggregate of the value of sale consideration received exceeds Rs. 50 lakhs in any previous year, irrespective of the fact that the sale is in course of the business or not. Thus, where a person, who is re-selling the goods, falls within the definition of the seller, he will be liable for the collection of tax. However, if a person, re-selling the goods, is not engaged in carrying on of any business, no tax shall be collected under this provision.

Example, Mr A (a salaried person) buys jewellery of Rs. 60 lakhs from a Jeweller. The Jeweller collects a tax of Rs. 1,000 (0.1% of Rs. 10 lakhs) under section 206C(1H). If Mr A re-sells the jewellery for Rs. 70 lakhs to the same jeweller, he shall not be liable to collect tax as he is not engaged in any business or profession. - 15. Whether additional, allied and out-of-pocket expenses form part of sale consideration?

- It is imperative to accurately determine the amount of sales consideration as it is relevant both for the applicability of the provision and amount from which tax should be collected. Additional, allied or out-of-pocket charges recovered from the customers may or may not form part of the sale consideration. Where these expenses have been reflected in the sales invoice itself, it should form part of the sale consideration. If they are charged through a separate invoice, it should not form part of the sale consideration.

- 16. From which date the threshold limit of Rs. 50 lakhs will be computed?

- The Finance Act 2020 inserted sub-section (IH) in section 206C, with effect from 01- 10-2020, to provide for the collection of tax on certain sales. The TCS has to be collected if the value or aggregate of the value of the sale consideration received during the previous year exceeds Rs. 50 lakhs. How this limit of Rs. 50 Lakh for collecting TCS shall be reckoned for the financial year 2020-21? Should it be from 01- 04-2020 or 01-10-2020?

The CBDT vide Circular No. l7, dated 29-09-2020, has clarified that since the threshold of Rs. 50 lakhs is with respect to the previous year, calculation of sale consideration for triggering TCS under this provision shall be computed from 01-04-2020. Hence, if a seller has already received Rs. 50 lakhs or more up to 30-09-2020 from a buyer, TCS under this provision shall apply on all receipts of sale consideration on or after 01-10- 2020. - 17. Whether TCS has to be collected on advance received from the buyer?

- TCS under section 206C(1H) is required to be collected on consideration received for the sale of goods. Section 4(3) of the Sale of Goods Act, 1930, provides that where under a contract of sale the property in the goods is transferred from the seller to the buyer, the contract is called a ‘sale’, but where the transfer of the property in the goods is to take place at a future time or subject to some condition thereafter to be fulfilled, the contract is called an ’agreement to sell’.

Section 206C(1H) provides that tax is required to be collected where the amount is received as consideration for the sale of goods. It does not mention whether such sale needs to be effected immediately or at a future date. As the tax is required to be collected at the time of receipt of consideration, it should be reasonable to conclude that the provision may get attracted even if such sale happened in past, happens in present or would happen in future. Further, the CBDT vide Circular No. 17, dated 29- 09-2020, has clarified that TCS is required to be collected under this provision from the advance received for sale.

As long as the intention is to adjust the advance payment against the future sale of goods, the tax should be collected at the time of receipt of consideration. If the advance payment is not made with an intention to adjust it against future sale (deposit or loan) but eventually it is adjusted against the future sale, no tax is required to be collected at the time of receipt of such advance. - 18. Whether advance received before 01-10-2020 for sale to be made after this date will be subjected to TCS?

- The CBDT side Circular No. 17, dated 29-09-2020 has clarified that provisions of section 206C(1H) shall not apply on any consideration received before 01-10-2020. Consequently, it would apply on all sale consideration, including advance received for sale, received on or after 01-10-2020 even if the sale was carried out before 01-10- 2020.

In simple words, the tax should be collected where the amount is received on or after 01-10-2020. Thus, where the trigger event (i.e., receipt of sale consideration) has occurred before the date of applicability of provision, no liability to collect tax will arise. On the contrary, where the sale has been made before the date of applicability of the provision but the sale consideration is received after the said date, the same shall be subject to TCS. - 19. Whether the amount received as loan from buyer shall come within the ambit of this provision?

- The requirement to collect TCS under this provision arises if the sale consideration received during the previous years exceeds the threshold. The collection is to be made at the time of receipt of the consideration for the sale of goods. Since the loan received from the buyers is not a consideration towards the sale of goods, it shall remain outside the purview of this provision. Hence, there is no requirement to collect TCS on loan received from the buyer. However, if at any future date, such loan amount is settled against sales consideration the liability to collect TCS shall arise. The tax shall be collected on the date on which parties agreed to adjust the loan amount against the outstanding liability.

- 20. Whether tax to be collected on the transfer of goods from one branch to another?

- The TCS under this section is required to be collected by any person, being a seller receiving consideration for the sale of goods. Thus, the existence of two distinct parties as “seller’ and ‘buyer’ is a pre-requisite to construe a transaction as a sale. The condition of sale is not fulfilled in the context of branch transfer. Therefore, the provisions of this section shall not apply in the case of branch transfers.

- 21. If the buyer has multiple units, whether sales made to different units need to be aggregated?

- Where tax is required to be collected at source, the collectee is required to furnish his PAN or Aadhaar number to the collector failing which the tax is required to be collected at higher rates. If the PAN or Aadhaar number is available, the threshold limit of Rs. 50 lakhs shall be computed in respect of each PAN or Aadhaar number. In other words, if different units of buyer are under the same PAN or Aadhaar number, the amount received from all such units shall be aggregated to compute the limit of Rs. 50 Lakhs.

- 22. Can a buyer apply for the certificate for lower collection of TCS?

- An assessee can apply to the Assessing Officer to issue a certificate for collection of tax at lower rates. Such certificate shall be issued if existing and estimated tax liability of assessee justifies collection of tax at a lower rate.

However, Section 206C(9) of the Income-tax Act does not extend the benefit to apply for lower tax collection at source for the section 206C(1H). Hence, the assessee does not have the option to approach the assessing officer to issue lower tax collection certificate for transactions covered under section 206C(1H). - 23. How to deposit the TCS?

- A corporate assessee and other assessees (who are subject to tax audit under Section 44AB) will have to make payment of tax (including TCS) electronically through internet banking facility or by way of debit cards. To deposit the tax, the collector has to fill the Challan No. ITNS 281.

Other collectors can deposit the tax so collected into any branch of the RBI or the State Bank of India or of any authorized bank. - 24. What shall be consequences for failure to collect or pay TCS?

- If any person, responsible for the collection of tax at source, fails to collect the whole or any part of the tax or after collection fails to deposit the same to the credit of the Central Government, then he shall be deemed to be assessee-in-default.

If a collector fails to collect or after collection fails to pay it to the credit of Central Government, he shall be liable to pay interest at the rate of 1% for every month or part thereof on the amount of tax he failed to collect or pay. The interest shall be calculated for the period starting from the date on which tax was required to be collected and ending on the date on which tax is deposited. The interest is required to be paid before furnishing the TCS return. - 25. Whether seller shall be treated as assessee in default if the buyer pays tax due on the income declared in the return of income?

- A seller is not deemed to be in default if the amount is received from a person who has considered such amount while computing income in the return and has paid the tax due on such declared income. The receiver will have to obtain a certificate to this effect from a Chartered Accountant in Form No. 27BA and submit it electronically.

- However, this relief is allowed only in respect of the following:

- 1. Sale of alcoholic liquor, scrap, etc. [Section 206C(1)]

2. Lease or licensing of parking lot or toll plaza or mine or quarry [Section 206C(1C)] - There is no reference of Section 206C(1H) under the provision providing the relief from being treated as an assessee in default. Hence, the seller shall continue to be deemed as assessee-in-default even if the buyer has taken in to account the purchase amount while computing his income and has paid tax due on the income declared in the return.

- 26. What shall be consequences of non-filing of TCS return?

- If there is a delay in filing of TCS return, the late filing fee shall be payable under Section 234E. The fee for default in furnishing the TDS/TCS Statement shall be levied at the rate of Rs. 200 per day during which such failure continues. However, the amount of fee shall not exceed the total amount deductible or collectable, as the case may be. The fee shall be payable before submission of the belated TDS/TCS Statement.

If a person fails to file the TCS return or does not file it by the due dates, he shall be liable to pay penalty under Section 271H. The penalty under Section 271H is also levied in case of furnishing of inaccurate information under TCS return. The minimum amount of penalty for failure to furnish TCS return or providing inaccurate information therein is Rs. 10,000 which can go up to Rs. 100,000. - 27. Is separate TAN required to obtain for the purpose of TCS?

- TAN allotted for TDS to be used for the purpose of TCS also. In other words, no separate TAN is required to obtain for the purpose of TCS, if the person already holds TAN for the purpose of TDS.

- 28. What is included in the term goods?

- The term “Goods” has not been defined in the Income tax act and hence reference is made to Section 2(7) of the Sale of Goods Act, 1930 which defines goods to “mean every kind of movable property other than actionable claims and money; and includes stock and shares, growing crops, grass, and things attached to or forming part of the land which are agreed to be severed before sale or under the contract of sale”.

For the purpose of Section 206C(1H), goods shall mean to include all goods as per above definition, however, the below goods shall be excluded since there are separate provisions u/s 206C for taxing these goods: • Alcoholic Liquor for human consumption • Tendu leaves • Timber obtained under a forest lease • Timber obtained by any mode other than under a forest lease • Any other forest produce not being timber or tendu leaves • Scrap • Minerals, being coal or lignite or iron ore • Motor vehicle (if value exceeds INR 10 Lakhs) Apart from the above, even goods exported out of India shall be excluded. - What are the due dates for payment and filing returns for the TCS so collected?

- 30. If Turnover in FY 2019-20 does not exceed INR 10 crores but sales to one customer exceeds INR 50 Lakhs after 30th September, 2020, will TCS u/s 206C(1H) provisions apply to such sales?

- TCS provision will not be applicable as the first condition for applicability of Section 206C (1H) is that the sales turnover of the preceding financial year should exceed INR 10 crores. Since the turnover in FY 2019-20 does not exceed INR 10 crores, there is no requirement of TCS even though sales to one party have exceeded INR 50 Lakhs after 30th September, 2020.

- 31. Whether TCS u/s 206C (1H) is to be collected on the total invoice amount inclusive of GST or only on the value of goods excluding GST?

- In our opinion, TCS is to be collected on amount excluding GST since the words used are ‘sales consideration’

- 32. Whether TCS u/s 206C (1H) has to be collected at the time of receipt of sales consideration and not at the time of raising sales invoice?

- As per Section 206(1H), TCS is required to be collected at the time of receipt of sales consideration; however, TCS should be mentioned in sales invoice so that the seller is able to quantify the amount of TCS to the buyer.

- 33. Impact of Credit notes and Debit notes?

- When credit note/debit note is booked before receipt of sale consideration, then the impact thereof will be included in the amount of consideration, and accordingly, on receipt of the revised consideration, the provisions of TCS would be applicable. If the amount of consideration is already received and TCS is collected and paid, no impact thereof will be required to be made at the time of passing entry for sales return/credit note/debit note. However, against the subsequent realization, if the same gets adjusted and net consideration is paid then on such net consideration TCS should be collected.

- 34. If the customer is deducting TDS under the Income Tax Act, whether the seller will be liable to collect TCS u/s 206C (1H)?

- No. If the customer is deducting TDS under the Income Tax Act on the transaction, the seller will not be liable to collect TCS u/s 206C(1H).

- 35. At which rate TCS is to be collected as per section 206C (1H) in case of absence of PAN/Aadhar from buyer?

- TCS is to be collected at the rate of 1% in absence of PAN/Aadhar by virtue of the Act.

- 36. Whether TCS u/s 206C (1H) has to be collected from all categories of customers?

- The seller shall not be liable to collect TCS u/s 206C(1H) from the below category of customers: • the Central Government, a State Government, an embassy, a High Commission, legation, commission, consulate and the trade representation of a foreign State; or • a local authority as defined in the Explanation to clause (20) of section 10; or • a person importing goods into India or any other person as the Central Government may, by notification in the Official Gazette, specify for this purpose, subject to such conditions as may be specified therein.

Newly introduced Section 206C(1H) to levy TCS @ 0.075%

| Section | Nature of Receipts | Reduced rate from 1st October 2020 to 31st March 2021* | Rate of TCS from 1st April 2021 onwards |

|---|---|---|---|

| 206C(1H) | Sale of goods (other than Alcohol, Tendu Leaves, Timber, Forest Produce, Scrap, Coal, Lignite, Iron or a Motor Vehicle) | 0.075%* | 0.1% |

*The prescribed rate of TCS u/s 206C(1H) is 0.1%. However, since the rates of TDS and TCS have been slashed by 25% due to the measures announced by the Finance Ministry in the wake of COVID-19, the rate u/s 206C(1H) stands reduced by 25% too.

Applicability of TCS u/s 206C (1H) for FY 2020-21

With respect to categories of customers, higher rate of TCS for non-furnishing PAN, practical examples on threshold limit of INR 50 lakhs and other issues Etc.

Clarification by Ministry of Finance vide Circular No. 17 of 2020 dated 29th September, 2020

Finance Act, 2020 also inserted sub-section (1H) in section 206C of the Act which mandates that with effect from 1′ day of October, 2020 a seller receiving an amount as consideration for sale of any goods of the value or aggregate of such value exceeding fifty lakh rupees in any previous year to collect tax from the buyer a sum equal to 0.1 per cent (subject to the provisions of proposed sub-section (10A) of the section 206C of the Act) of the sale consideration exceeding fifty lakh rupees as income-tax. The collection is required to be made at the time of receipt of amount of sales consideration.

Guidelines;

Applicability on transactions carried through various Exchanges:

It has been represented that there are practical difficulties in implementing the provisions of Tax Deduction at Source (TDS) and Tax Collection at Source (TCS) contained in section 194-0 and sub-section (1H) of section 206C of the Act in case of certain exchanges and clearing corporations. It has been stated that sometime in these transactions there is no one to one contract between the buyers and the sellers.

In order to remove such difficulties, it is provided that the provisions of section 194-0, and sub-section (1H) of section 206C, of the Act shall not be applicable in relation to,-

(i) transactions in securities and commodities which are traded through recognized stock exchanges or cleared and settled by the recognized clearing corporation, including recognized stock exchanges or recognized clearing corporation located in International Financial Service Centre;

(ii) transactions in electricity, renewable energy certificates and energy saving certificates traded through power exchanges registered in accordance with Regulation 21 of the CERC; and

For this purpose,-

(i) “recognized clearing corporation” shall have the meaning assigned to it in clause (i) of the Explanation to clause (23EE) of section 10 of the Act;

(ii) “recognized stock exchange” shall have the meaning assigned to it in clause (ii) of the Explanation 1 to sub-section (5) of section 43 of the Act; and

(iii) “International Financial Services Centre” shall have the meaning assigned to it in clause (q) of section 2 of the Special Economic Zones Act, 2005.

Calculation of threshold for the financial year 2020-21.

1. Since sub-section (I H) of section 206C, of the Act would come into effect from 1st October, 2020, it was requested to clarify how the various thresholds specified under these sections shall be computed and whether the tax is required to be deducted/collected in respect of amounts received before 1st October, 2020.

2. It hereby clarified that,-

(i) Since sub-section (1H) of section 206C of the Act applies on receipt of sale consideration, the provision of this sub-section shall not apply on any sale consideration received before 1st October 2020. Consequently it would apply on all sale consideration (including advance received for sale) received on or after 1st October 2020 even if the sale was carried out before 1st October 2020.

(ii) Since the threshold of fifty lakh rupees is with respect to the previous year, calculation of receipt of sale consideration for triggering TCS under sub-section (1 H) of section 206C shall be computed from 1st April, 2020. Hence, if a person being seller has already received fifty lakh rupees or more up to 30th September 2020 from a buyer, the TCS under sub-section (1H) of section 206C shall apply on all receipt of sale consideration during the previous year, on or after 1st October 2020, from such buyer.

Applicability to sale of motor vehicle:

1. The provisions of sub-section (1F) of section 206C of the Act apply to sale of motor vehicle of the value exceeding ten lakh rupees. Sub-section (1H) of section 206C of the Act exclude from its applicability goods covered under sub-section (1F). It has been requested to clarify that whether all motor vehicles are excluded from the applicability of sub-section (1H) of section 206C of the Act.

2. It this regard it may be noted that the scope of sub-sections (1H) and (IF) are different. While sub-section (1F) is based on single sale of motor vehicle, sub-section (1H) is for receipt above 50 lakh rupee during the previous year against aggregate sale of good. While sub-section (1F) is for sale to consumer only and not to dealers, sub-section (1H) is for all sale above the threshold. Hence, in order to remove difficulty it is clarified that,-

(i) Receipt of sale consideration from a dealer would be subjected to TCS under sub-section (1H) of the Act, if such sales are not subjected to TCS under sub-section (1F) of section 206C of the Act.

(ii) In case of sale to consumer, receipt of sale consideration for sale of motor vehicle of the value of ten lakh rupees or less to a buyer would be subjected to TCS under sub-section (1H) of section 206C of the Act, if the receipt of sale consideration for such vehicles during the previous year exceeds fifty lakh rupees during the previous year.

(iii) In case of sale to consumer, receipt of sale consideration for sale of motor vehicle of the value exceeding ten lakh rupees would not be subjected to TCS under sub-section (1H) of section 206C of the Act if such sales are subjected to TCS under sub-section (1F) of section 206C of the Act.

Adjustment for sale return, discount or indirect taxes:

1. It is requested to clarify that whether adjustment is required to be made for sales return, discount or indirect taxes including GST for the purpose of collection of tax under sub-section (1H) of section 206C of the Act. It is hereby clarified that no adjustment on account of sale return or discount or indirect taxes including GST is required to be made for collection of tax under sub-section (1H) of section 206C of the Act since the collection is made with reference to receipt of amount of sale consideration.

Fuel supplied to non-resident airlines:

1. It is requested to clarify if the provisions of sub-section (IH) of section 206C of the Act shall apply on fuel supplied to non-resident airlines at airports in India. To remove difficulties it is provided that the provisions of sub-section (1 H) of section 206C of the Act shall not apply on the sale consideration received for fuel supplied to non-resident airlines at airports in India.

FAQs on This New Levy

| Particulars | FY 2019-20 | FY 2020-21 | FY 2021-22 | FY 2022-23 |

|---|---|---|---|---|

| Sale(A) | 60,00,000 | 70,00,000 | 55,00,000 | 55,00,000 |

| Outstanding balance as on the first day of the year (B) | – | 40,00,000 | 10,00,000 | 20,00,000 |

| Total Receipt(C) | 20,00,000 | 1,00,00,000 (Rs. 55 lakhs received on or before 30-09-2020) | 45,00,000 | 65,00,000 |

| Outstanding balance as on last day of the year (D = A + B -C) | 40,00,000 | 10,00,000 | 20,00,000 | 10,00,000 |

| Tax to be collected | Nil (Note 1) | Rs.4,500 (Note 2) | Nil (Note 3) | Rs.1,500 (Note 4) |

Note 1: As Section 206C(1H) is applicable from 01-10-2020, no tax to be collected in the financial year 2019-20.

Note 2: Tax will be collected only in respect of sale consideration received on or after 01-10- 2020, i.e. Rs. 45,00,000 * 0.1% = Rs. 4,500

Note 3: No tax shall be collected as the amount of sale consideration received during the year does not exceed Rs. 50 lakhs.

Note 4: The tax shall be collected on receipt in excess of Rs. 50 lakhs, i.e. 15,00,000 * 0.1% = 1,500

| Month in which TCS collected | Due date for payment of tax | Due date for filing return |

|---|---|---|

| April | 7th May | 15th July |

| May | 7th June | 15th July |

| June | 7th July | 15th July |

| July | 7th August | 15th October |

| August | 7th September | 15th October |

| September | 7th October | 15th October |

| October | 7th November | 15th January |

| November | 7th December | 15th January |

| December | 7th January | 15th January |

| January | 7th February | 15th May |

| February | 7th March | 15th May |

| March | 7th April | 15th May |

We have addressed genuine queries that usually arise while referring to the provision of section 206C (1H) of the Act through FAQ. However, the applicability of section 206C(1H) have brought a major compliance burden to the taxpayers at initial stage and the professionals are going to have an equally hard time coping up with all the due dates and reporting the same transactions, multiple times to different authorities.

Compiled by

Mr. Roshan Shetty & Mr. Surendra Rajpurohit

784 total views, 1 views today